UPDATED JANUARY 2024

Tronc schemes have been around for a while, but although there may be an awareness of the name when hospitality businesses contact us, they are often unclear about how troncs work.

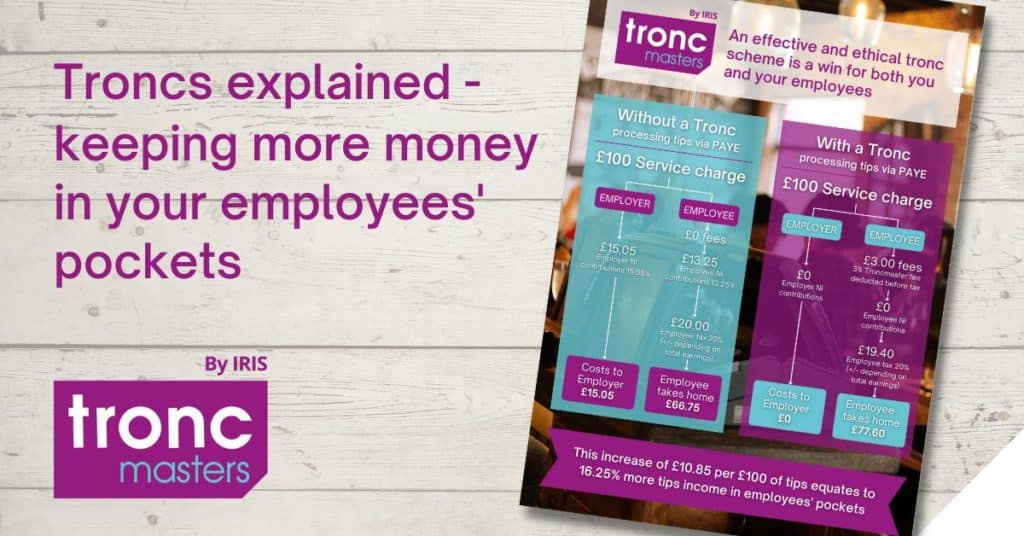

So we have developed this simple diagram that explains the monetary impact of an effective tronc for both employer and employee. Because troncs are a win, win for both parties, and in today’s economic climate, there aren’t many instances where you can say that!

Let’s start at the beginning.

A tronc is a pay arrangement that allows for the fair distribution of pooled tips and service charges given by customers to employees.

Troncs are becoming more prevalent as customers move away from paying by cash or leaving cash tips to card and contactless payment and tipping methods. However, when tips land in the business bank account, it becomes mandatory to pay the tips to employees through the payroll, and there begins the challenge as to how these should be distributed to employees.

It may seem as simple as adding to their pay, but by doing this, the tip amount attracts not only tax but also National Insurance for both the employer and employee. However, with a correctly set up tronc scheme, the tips are paid out to employees through the tronc and do not incur National Insurance payments.

A financial win for all parties

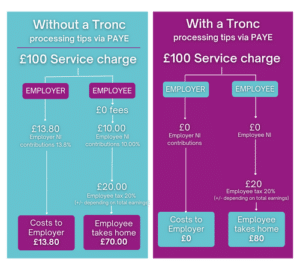

If we take a sum of £100 in pooled tips as a simple example; without a tronc scheme, the employer will pay £13.80 (13.80%) National insurance (ERs), and the employee would pay £10.00 (10.00%) in NI (EE’s) in addition to their income tax, for all employees earning above the NIC thresholds.

Using a tronc scheme to distribute the tips, the same £100 would not attract National insurance, either ERs or EEs, saving additional costs for the employer and giving more of the tip amount to the employee. It could equate to a 14.12% increase in the value of tips for the employee.

With tips often making up a considerable part of a hospitality employee’s take-home pay, this percentage increase is significant, especially as we are in the midst of a cost of living crisis.

What about the costs of the tronc administration?

As you can see from our example, we have factored in the cost of administering the tronc through a third party, which can be as a percentage of the tips, a fixed fee, or a mixture of both.

Currently, this can be taken out of the tronc tips pool, and this arrangement would be made clear and agreed upon by the tronc members (employees). However, some clients we have worked with have decided to take on this cost rather than deduct it from the tips pool as a further commitment to their staff.

The much-awaited Allocation of Tips legislation will be law from July 2024 and is designed to ensure all tips go to staff by making it unlawful for businesses to hold back tips and service charges from their employees.

Want to know more about tronc schemes and how to get started? Contact our Troncmaster experts to learn more.