Cost savings with a tronc scheme

Being compliant and cost-efficient with your tips policy

No matter how they are received, tips are taxable income and always subject to income tax. This could be deducted at source or collected through self-assessment of the recipient.

New legislation (Allocation of Tips Bill 2023) states that 100% of discretionary tips, gratuities and service charges must go to staff, and none can be retained by the employer, even to cover processing or administrative costs.

If you operate a compulsory service charge, this is a non-discretionary tip, and the monies collected are classed as business income. Like other business revenue, it is subject to VAT, income tax and corporate tax.

Direct tipping vs pooled tips

The new Allocation of Tips Legislation has put a legal framework for employers to work to when operating their tips policy. However, there is still a choice between a direct tipping and pooled or shared tips approach.

With direct tipping, the tip amount goes to the person receiving the tip, such as the waiter or bartender. Whether in cash, via card transactions, or through Tipping Apps, if the tips are allocated direct from customer to an individual in full, they are classed as direct tips and cannot be part of a tronc scheme.

With direct tipping, as they are not part of a tronc scheme, they are classed as employee income and, as such, are subject to income tax and if processed through the PAYE, the amounts attract Employee and Employers’ National Insurance.

Pooled or shared tips are when the collected discretionary tips and service charges are distributed amongst a wider team than the person who received the tip. This is common for items such as food, which require a team effort to produce, so it is fair that the whole team benefit from the customer tip.

Save on National Insurance tax with a tronc scheme

With direct tipping, as they are not part of a tronc scheme, they are classed as employee income and, as such, are subject to income tax and if processed through the PAYE, the amounts attract Employee and Employers’ National Insurance.

Pooled or shared tips are when the collected discretionary tips and service charges are distributed amongst a wider team than the person who received the tip. This is common for items such as food, which require a team effort to produce, so it is fair that the whole team benefit from the customer tip.

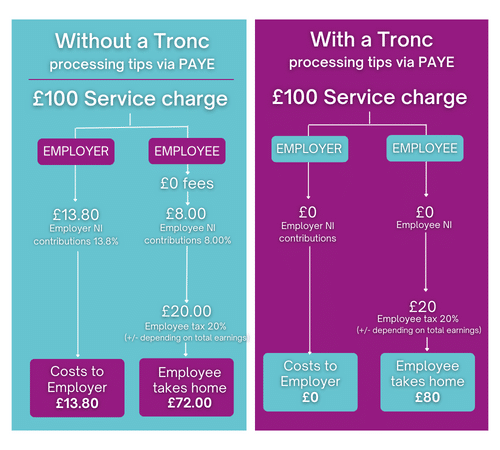

A more cost-efficient way of processing discretionary tips is via a tronc scheme. A compliant tronc scheme is not subject to NI, saving the employer and employee.

Check out our online Tronc Calculator to see how much it could save for your business and employees.

Don’t miss out

Keep up to date with the latest legislation, advice and tips